Are you feeling overwhelmed by your taxes this year? Don’t worry, you’re not alone! Taxes can be confusing and stressful for many people. One way to make the process easier is by using a Schedule D tax worksheet.

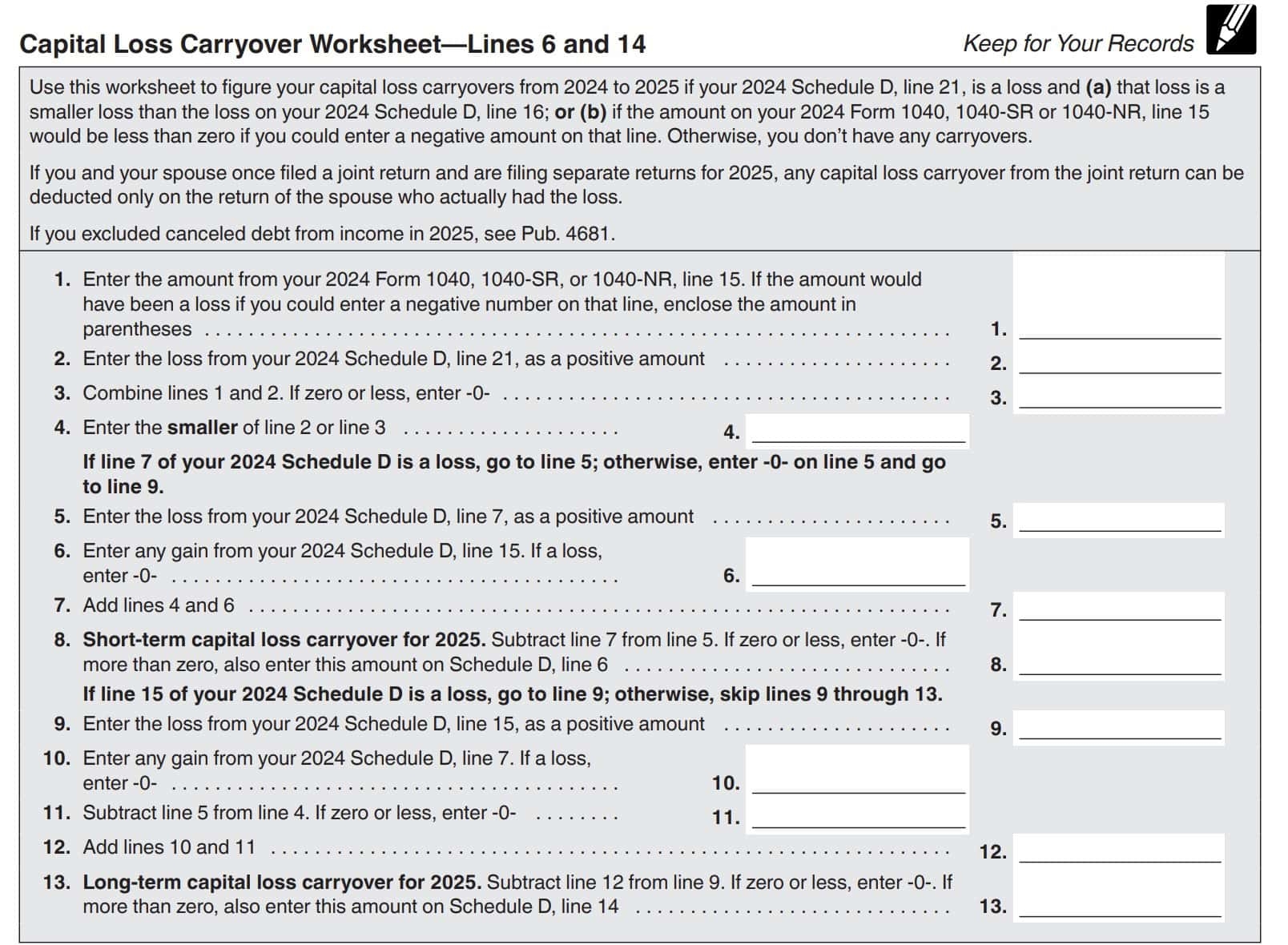

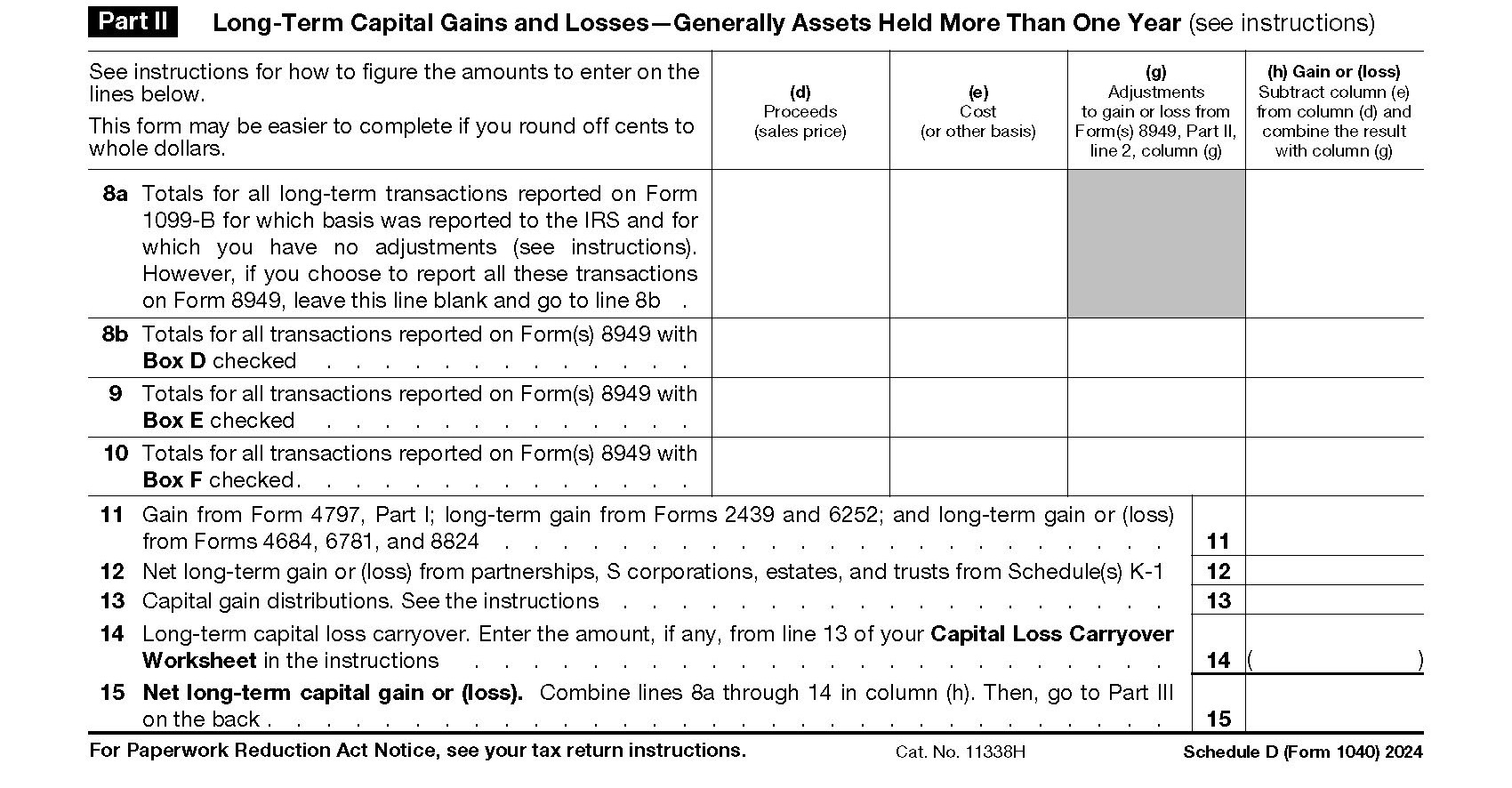

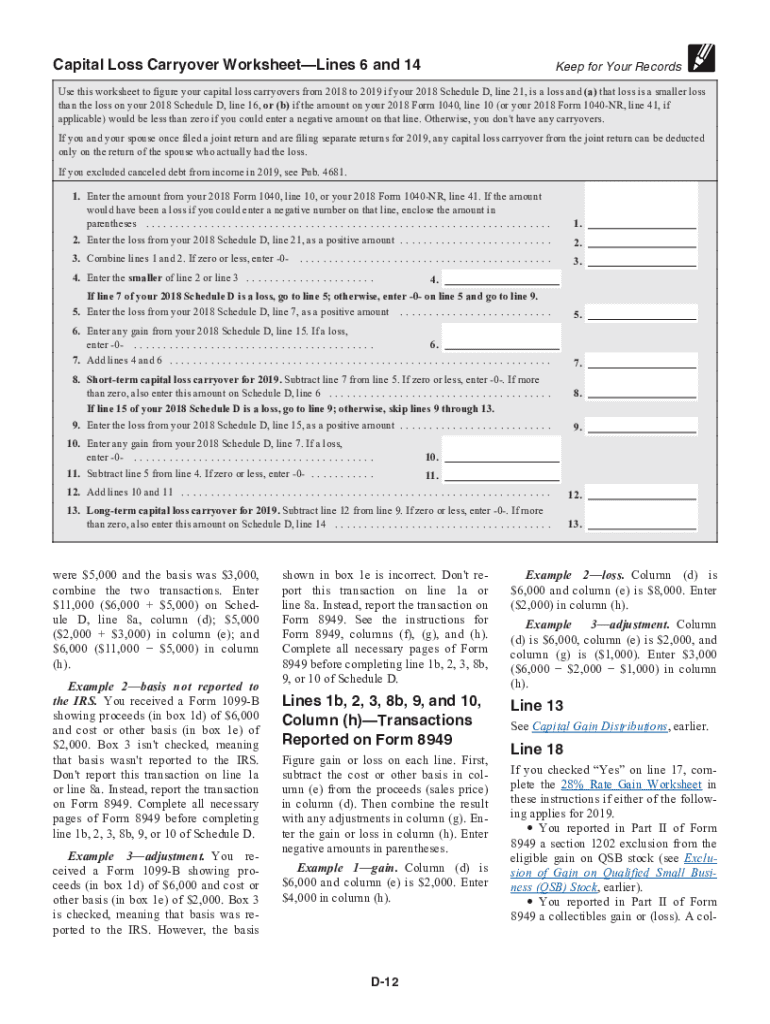

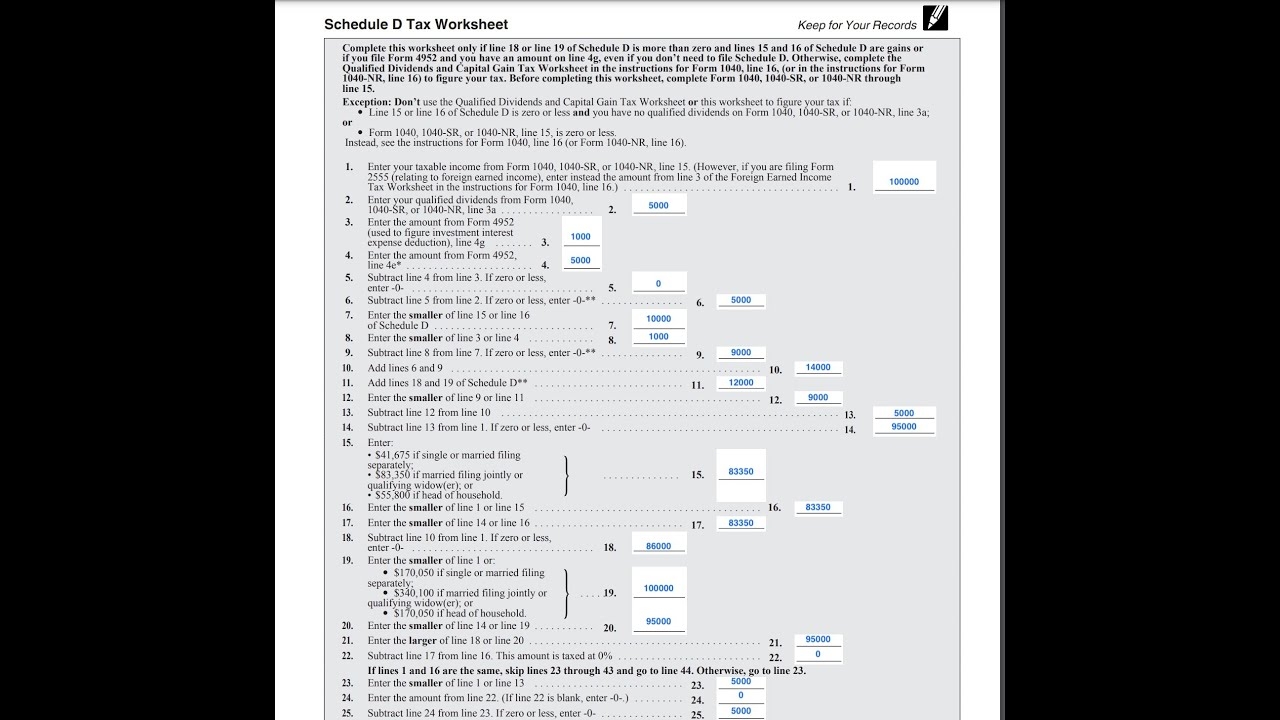

A Schedule D tax worksheet is a helpful tool that can assist you in calculating your capital gains and losses. It provides a step-by-step guide to help you fill out your Schedule D form accurately and efficiently. Whether you’re a seasoned investor or a beginner, this worksheet can simplify the tax filing process for you.

schedule d tax worksheet

The Importance of Using a Schedule D Tax Worksheet

By using a Schedule D tax worksheet, you can ensure that you are reporting your capital gains and losses correctly. This can help you avoid costly mistakes and potential audits from the IRS. The worksheet will also help you organize your financial information and make tax preparation less daunting.

Additionally, the worksheet can help you identify any tax-saving opportunities that you may have overlooked. By carefully filling out the worksheet, you can potentially reduce your tax liability and keep more money in your pocket. It’s a simple yet effective way to maximize your tax savings.

Don’t let taxes stress you out this year. Take advantage of the benefits of using a Schedule D tax worksheet to streamline the tax filing process and ensure accuracy in reporting your capital gains and losses. With this helpful tool, you can navigate the complexities of taxes with ease and confidence.

So, next time you’re preparing your taxes, consider using a Schedule D tax worksheet to simplify the process and optimize your tax savings. You’ll thank yourself when tax season rolls around again!

How To Complete IRS Schedule D Form 1040

Schedule D Instructions Fill Out Sign Online DocHub

Schedule D Tax Worksheet Walkthrough YouTube

IRS Schedule D Instructions