Are you wondering how to calculate your taxable social security benefits? It can be a bit confusing, but don’t worry, we’re here to help break it down for you.

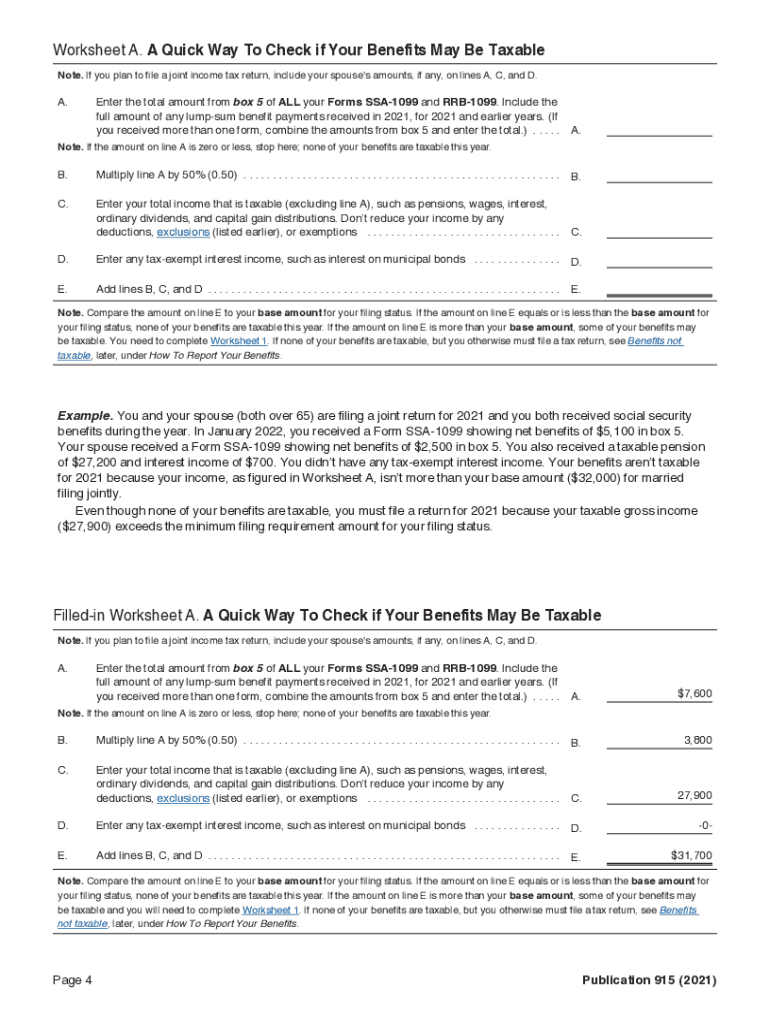

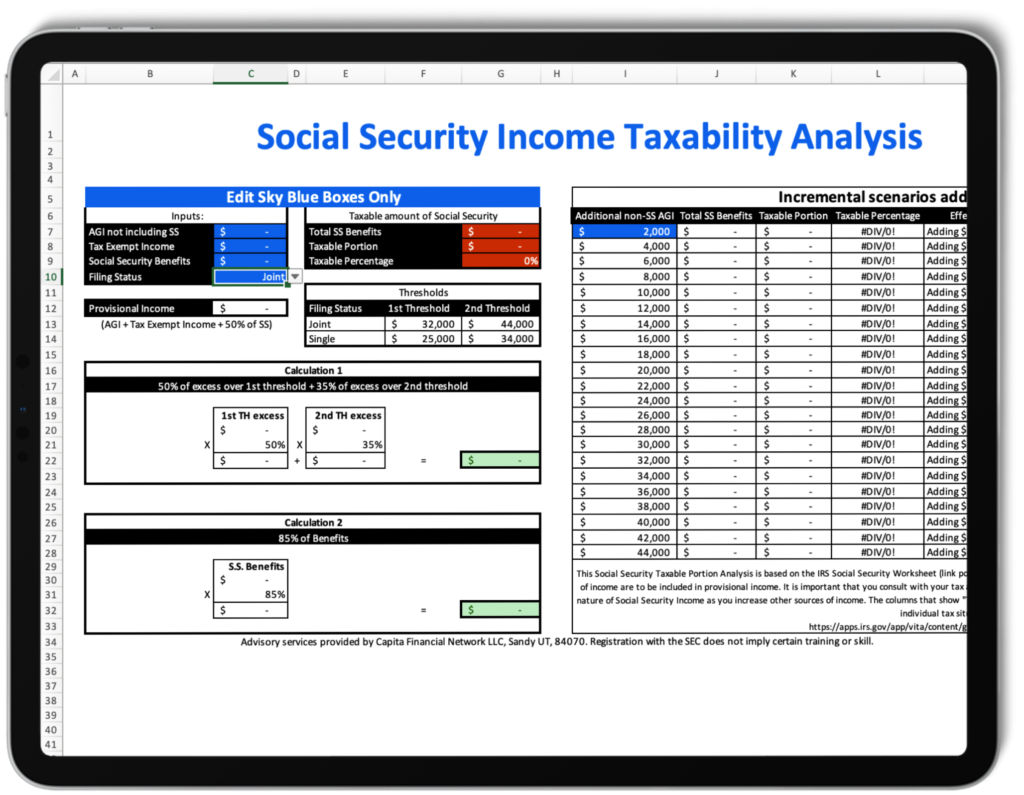

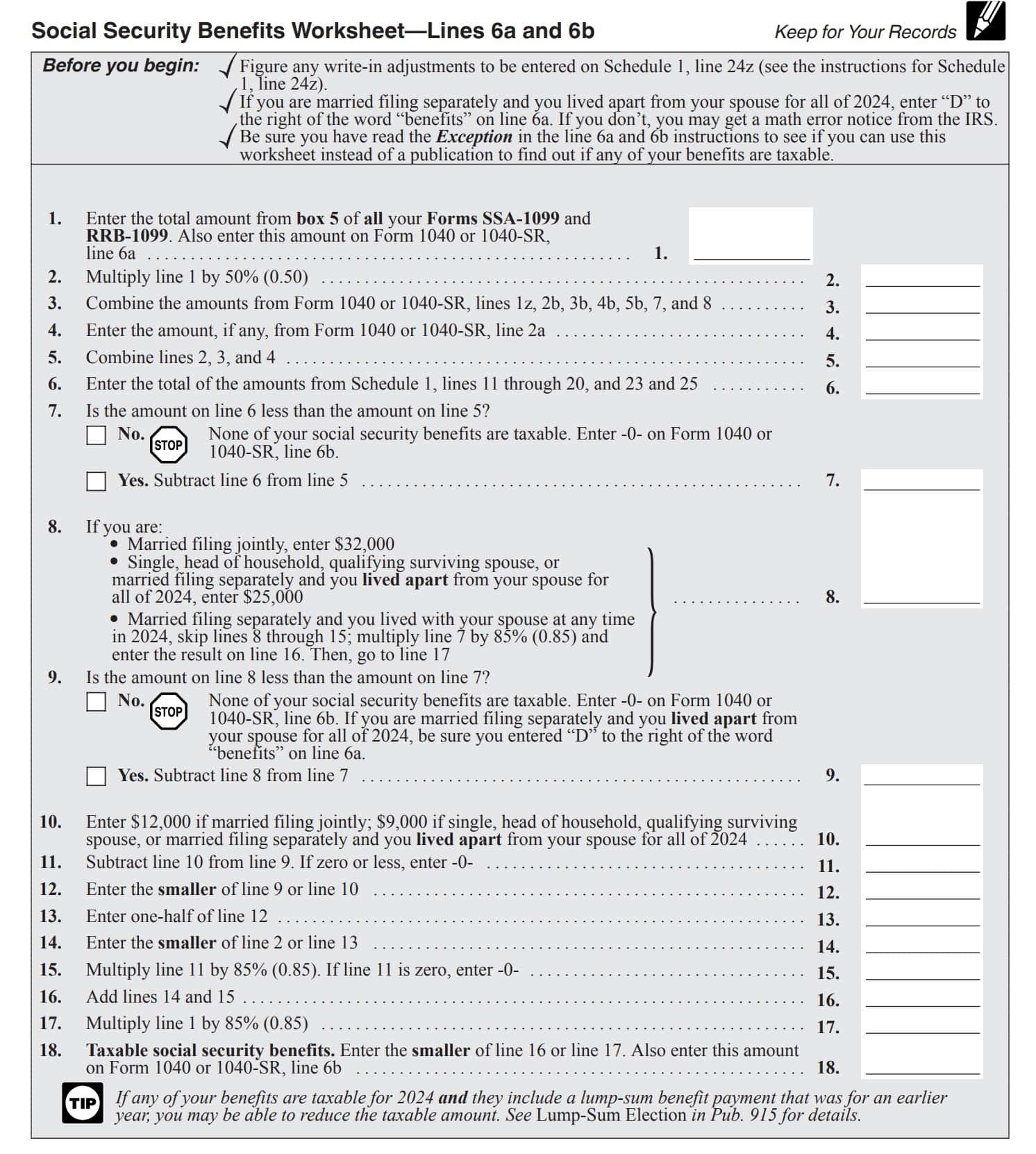

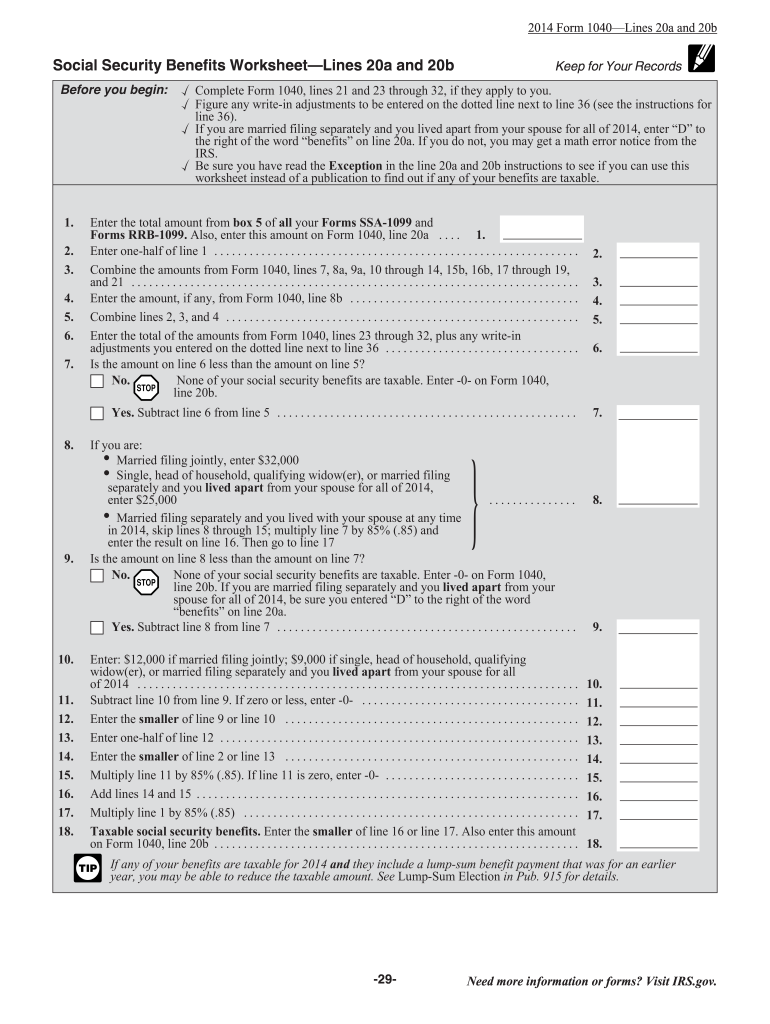

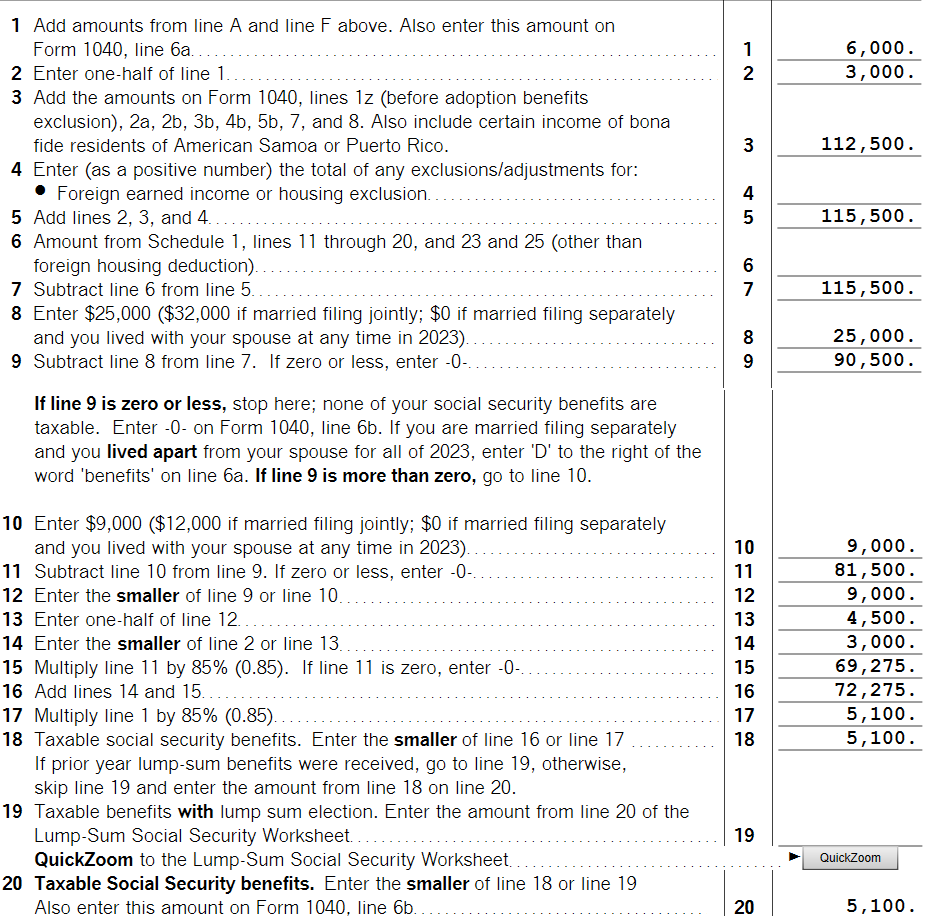

When it comes to figuring out your taxable social security benefits, the IRS has a handy worksheet that can help simplify the process. By using the taxable social security benefits worksheet, you can determine how much of your benefits are subject to taxation.

taxable social security benefits worksheet

Understanding the Taxable Social Security Benefits Worksheet

The taxable social security benefits worksheet takes into account your filing status, total income, and half of your social security benefits to calculate the taxable portion. It’s a straightforward tool that can give you a clear picture of your tax liability.

By following the instructions on the worksheet, you can fill in the necessary information and arrive at the taxable amount of your social security benefits. This can help you plan ahead and avoid any surprises come tax time.

It’s important to note that not all social security benefits are taxable. Depending on your income level, you may not owe any taxes on your benefits. The worksheet will guide you through the process and ensure you’re in compliance with IRS regulations.

So, next time you’re trying to figure out how much of your social security benefits are taxable, turn to the IRS’s handy worksheet for assistance. It’s a simple tool that can save you time and hassle when it comes to filing your taxes.

Social Security Worksheet The Retirement Nerds

Form SSA 1099 Instructions Social Security Benefits

Taxable Social Security Worksheet 2023 Fill Out Sign Online Worksheets Library

Solved Taxable Social Security Worksheet